File Your SR&ED Claim Without a Consultant

Our AI-powered platform helps Canadian startups file their SR&ED claim faster and smarter. Learn, prep, and submit—stress-free and audit-ready.

Built for Canadian founders | AI-powered tools | Save 95% in consultant fees

Simplify Your SR&ED Claim with DIY SR&ED

Use our AI-powered platform to assess eligibility, prepare your SRED claim, and file with confidence—without expensive consultants.

Self-Assessment Tools

Quickly check if your project qualifies for an SR&ED claim in Canada with our guided eligibility tool.

AI-Powered Claim Builder

Automatically structure your SR&ED claim with smart prompts, documentation templates, and filing checklists.

Educational Resources

Access expert-curated guides, videos, and examples to learn how to maximize your refund and avoid common mistakes.

Startup-Friendly Pricing

Save thousands in consultant fees with transparent, affordable tools built for founders—not firms.

Start Your Free Self-Assessment

Takes 2 minutes. No tax knowledge required.

Why Founders Choose DIY SR&ED

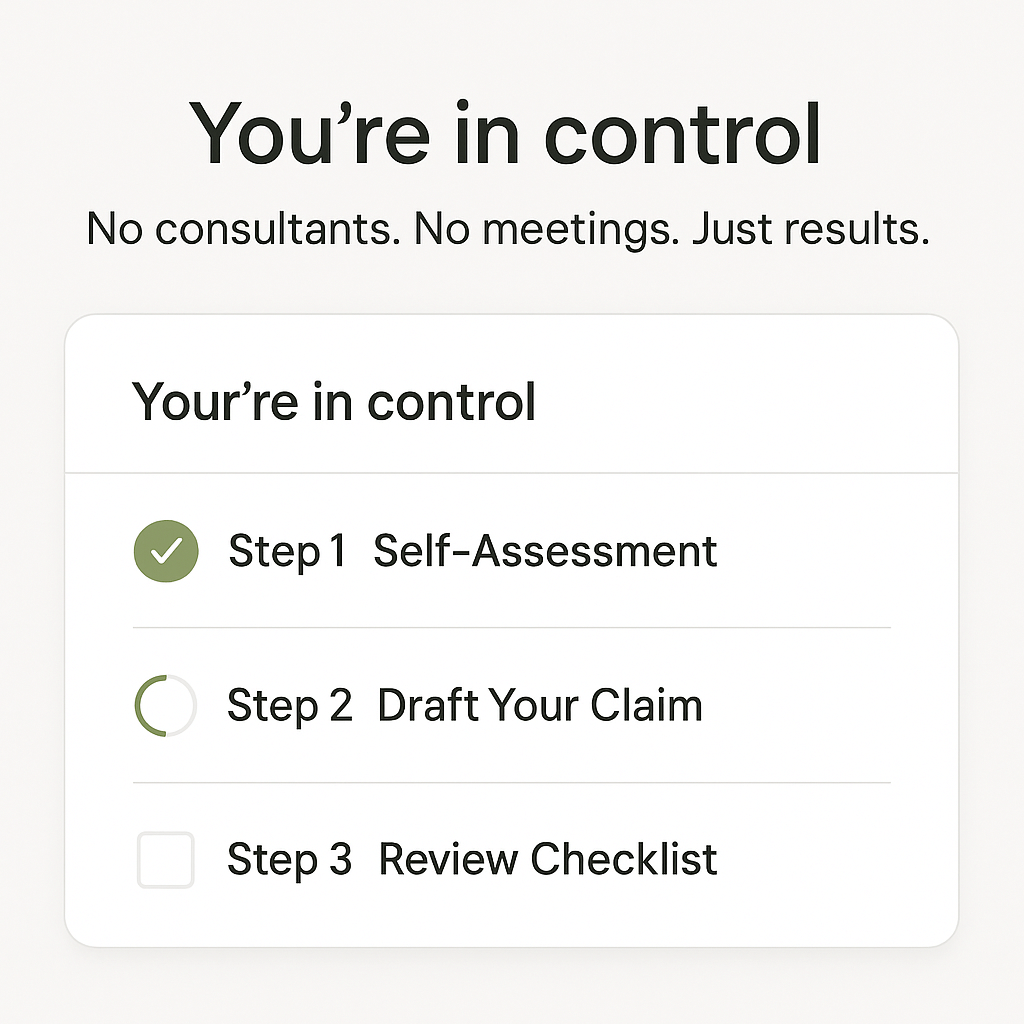

1. Full Control Over Your Claim

No need for overpriced consultants or endless meetings.

Use our guided SR&ED claim preparation tools to stay in control—from your first draft to audit readiness.

2.Faster Filing, Fewer Surprises

Skip the back-and-forth.

With instant access to checklists and smart automation, you can file your SRED claim ahead of deadlines—on your own time.

3. Built for Startups, Not Tax Experts

No jargon, no overwhelm.

We’ve simplified the SR&ED claims process in Canada with easy-to-understand guides and tools tailored for founders and technical teams.

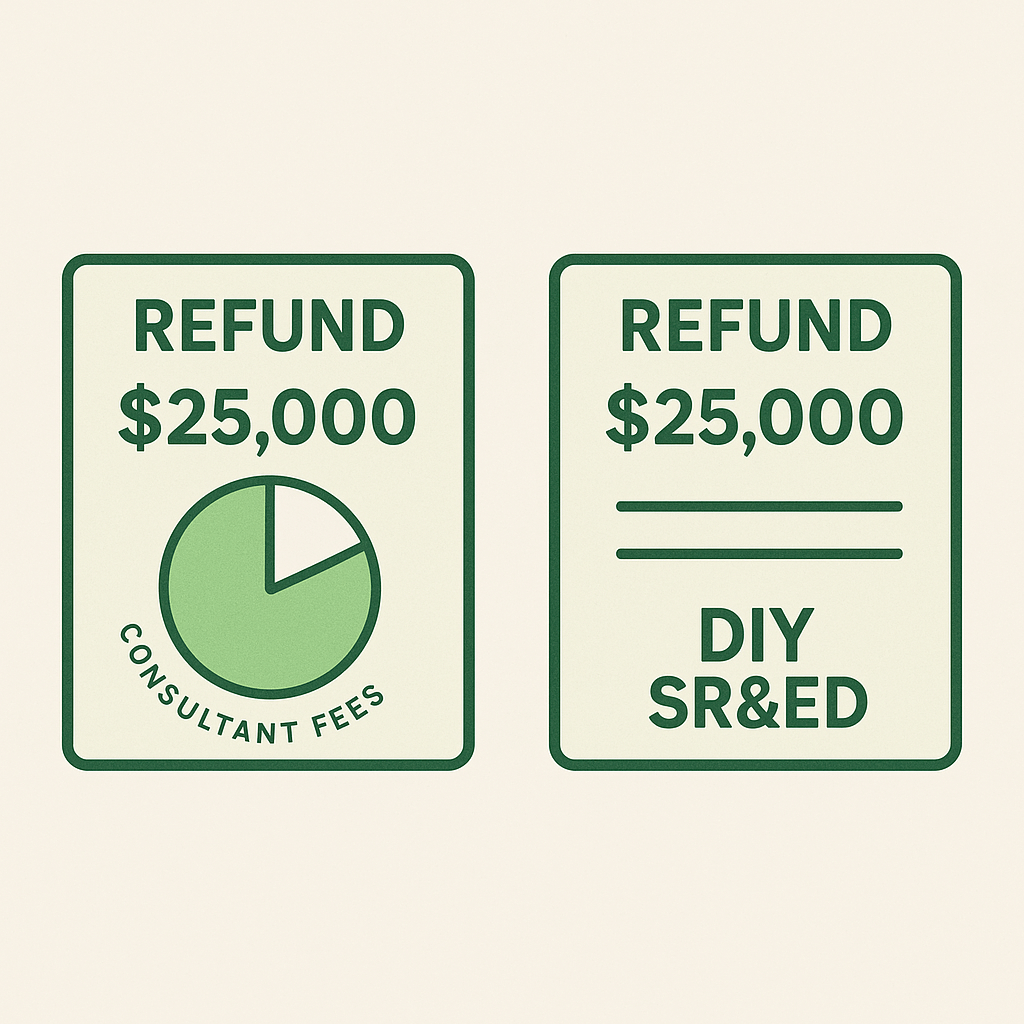

4. Max Refund, Min Cost

Don’t lose a chunk of your refund to third-party fees.

We help you unlock your maximum SR&ED claim value—affordably and transparently.

Start Your Claim — No Consultant Needed

It’s free to start. No sales calls. No strings.

Got SR&ED Questions?

We’ve answered the top questions startup founders ask about SR&ED claims. Want more details?

- What is the SR&ED tax credit program? It’s a Canadian government program that gives you money back for doing research or developing new technology. If you’re building cool stuff, you might be eligible!

- Can I file an SR&ED claim myself? Absolutely. That’s exactly why we built DIY SR&ED — to help founders like you skip the consultants and take control of the process with smart tools and clear guidance.

- How does DIY SR&ED help with claims? We guide you step-by-step with a self-assessment tool, helpful checklists, and smart automation. You’ll get everything you need to file your claim with confidence — and without the stress.

Blog

Explore expert tips, in-depth guides, and industry updates to help you master your SR&ED claims.

-

T661 Form Guide: How to File Your First SR&ED Claim

Filing your first SR&ED claim and looking for a simple T661 form…

-

SR&ED Audit: How to Prepare Your Startup for a Smooth CRA Review

Filing your SR&ED claim is step one—making it through an SR&ED audit…

-

How to Apply for SR&ED: A Startup-Friendly Step-by-Step Guide

Wondering how to apply for SR&ED as a startup? You’re in the…